can you go to prison for not filing taxes

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve. However you can face jail time if you.

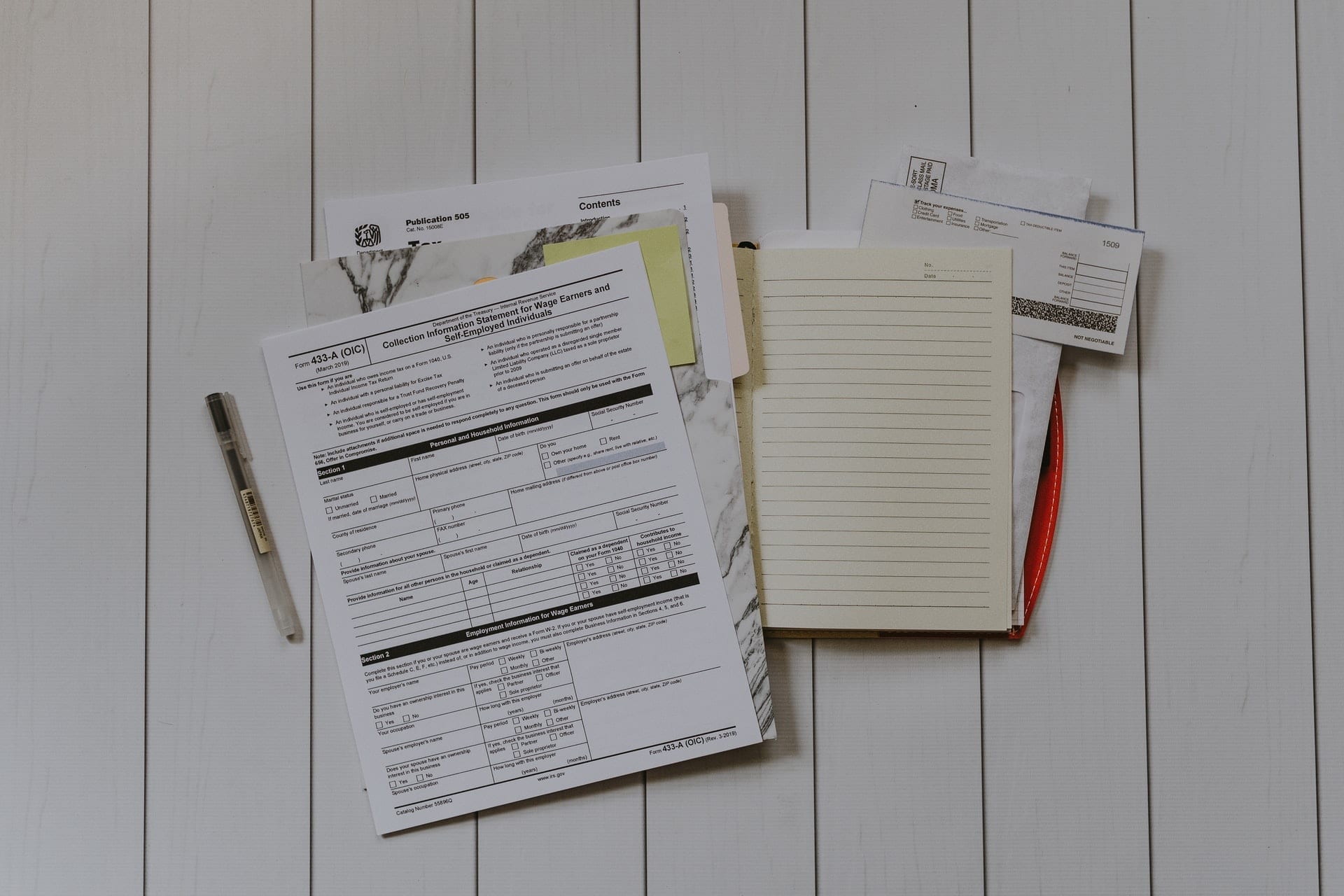

How To File Your Taxes If Your Spouse Is Incarcerated

Can you go to jail for not filing a tax return.

. In short yes you can go to jail for failing your taxes. While the IRS can pursue charges against you beginning after that first year you fail to file. The IRS imposes a 5-year prison sentence on anyone who files.

Although it is very unlikely for an individual to receive a jail sentence for. Beware this can happen to you. If you fail to file a tax return and arent.

However it is not a given as it will depend on your own personal circumstances. The short answer is maybe it depends on why youre not paying your taxes. In addition to his eight-month prison sentence Sorrentino also received two years of supervised release 500 hours of community service and a 10000 fine.

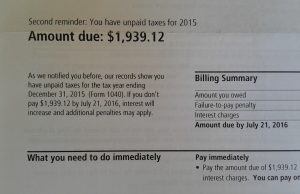

The IRS will charge you 05 every month you fail to pay up to 25. The maximum failure-to-file penalty is 25. Ad Based On Circumstances You May Already Qualify For Tax Relief.

Any action you take to evade an assessment of tax can get one to five years in prison. If you cannot afford to pay your taxes the IRS will not send you to jail. Whether you forgot to file your taxes just didnt feel like filing your taxes or had more sinister and potentially criminal reasons for not filing your taxes the IRS will likely send.

However if you do not file and pay the failure to file the amount is subtracted from the failure to pay the amount. While the IRS can pursue charges against you beginning after that first year you fail to file. If youve committed tax evasion or helped someone else commit tax evasion you should expect to end up in jail.

The extension allows you to file at a suitable time even after the tax deadline. If your return is more than 60 days late the minimum. The penalty is usually 5 of the tax owed for each month or part of a month the return is late.

It depends on the situation. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5. You would need to fill out Form 4868 Application for Automatic Extension of Time to File United.

May 4 2022 Tax Compliance. The question can you go to jail for not filing taxes is complicated and multifaceted. In addition to a prison term the US.

Courts will charge you up to 250000 in fines. And you can get one year in prison for each year you dont file a return. Failing to file a return can land you in.

Regardless it is incredibly important that you. The short answer is maybe. The question can you go to jail for not filing taxes is complicated and multifaceted.

Failure to File a Return. Whether a person would actually go to jail for not. We Help Taxpayers Get Relief From IRS Back Taxes.

The following actions can land you in jail for one to five years. By and large the most common penalties the IRS issues are fines and interest. Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen.

The following actions can lead to jail time for one to five years. The short answer to the question of whether you can go to jail for not paying taxes is yes. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years.

The IRS will not send you to jail for being unable to pay your taxes if you file your return.

Can You Go To Jail For Not Paying Your Taxes Paladini Law

What Are The Irs Penalties And Interest For Filing Taxes Late Cbs News

Can I Go To Jail For Not Paying My Taxes Lawyer Blogger

Average Jail Time For Tax Evasion Convictions Prison

Here S What Happens If You Don T File Your Taxes Bankrate

Will I Go To Jail If I Refuse To Pay War Taxes National War Tax Resistance Coordinating Committee

Monday Is Tax Day Here S What Happens If You File Late Oregonlive Com

Can You Go To Prison For Not Paying Taxes Prison Insight

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

Can You Go To Prison For Not Paying Or Not Filing Your Taxes

Can You Go To Jail For Not Paying Taxes How To Avoid Arrest For Tax Evasion

Tax Evasion In The United States Wikipedia

Civil And Criminal Penalties For Failing To File Tax Returns

Penalties For Claiming False Deductions Community Tax

Can You Go To Jail For Not Paying Taxes Youtube

Filing Taxes When Incarcerated How To Justice

Filing Taxes If You Are Currently Incarcerated Or Re Entering Society Get It Back

When Will The Irs File Federal Charges Against You Tax Debt Relief Services