travel nurse taxes in california

Stipends and per diems have NOT been changed by tax reform. Employers can use a.

How To Make The Most Money As A Travel Nurse

FREE REVIEW OF PREVIOUSLY FILED TAX RETURNS.

. Travel Nurse Tax Pro has simplified the process to efficiently gather the information necessary to complete your return accurately without burdening you with complicated forms and workbooks. You must establish a travel nurse tax home in order to qualify for the beneficial tax-free income of travel assignments. Any expenses incurred from working away from your tax home have the opportunity to be reimbursed with non-taxable money.

Your listed bill rate typically takes all of this into account. There are two ways you can be paid as a travel nurse. When filing our taxes all of us are looking for deductions items that lower our tax liability.

A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. 250 per week for meals and incidentals non-taxable. Travel Nursing Tax Deduction 1.

But it is pretty close. Estimated taxes or quarterly taxes should. Critical Care Travel Nurse.

What kind of records should I keep. Although your recruiter will most likely give you direction when it comes to taxes they probably only know very basic information that may not apply to your. You will also need to pay estimated taxes since there are no tax withholdings for independent contractors.

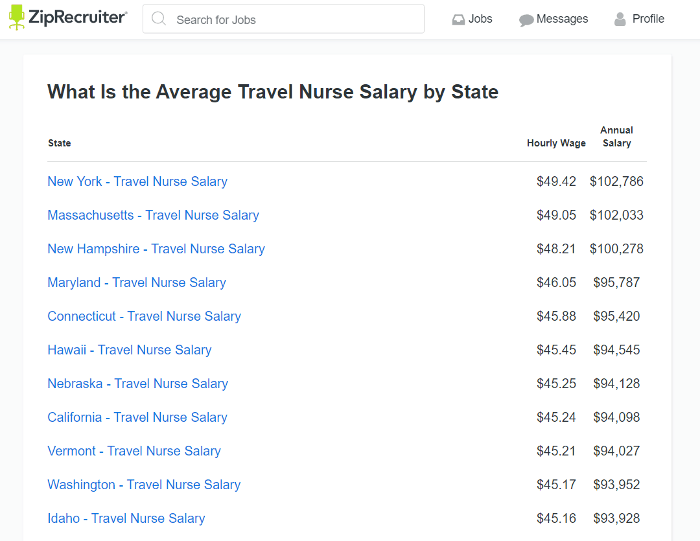

Emergency Room Travel Nurse. Travel Nursing Pay Rates Vary Wildly In California. But many states including California use a percentage based approach to figuring out taxes due plus different personal exemptions so it may not be exact per my first sentence.

Taxes and travel nursing can be very complicated so its best to consult an accountant for assistance. Make sure you qualify for all non-taxed per diems. Labor and Delivery Travel Nurse.

At Travel Nurse Tax we are an independent tax preparation firm and our focus is on the tax needs of travelers and non-travelers alike. As a travel nurse there are some deductions that can save you a significant tax burden such as maintaining the things necessary to create a tax home travel expenses to your place of work if your tax home is separate from your place of employment and professional expenses. Earning 2100 per week sounds better than 1800 per week but if the former job contract is 40 hours each week and the latter is only 20 hours a week ask yourself if you really need the extra 300.

This means travel nurses can no longer deduct travel-related expenses such as food mileage gas and license fees and the only way to recuperate this money is either through a stipend from your travel agency or in the form of reimbursements for expenses you actually. The caveat here is that you must be able to consider a tax home. So lets take a closer look.

To make matters worse travel nurse taxes are probably the most challenging and disliked part about travel nursing. Basically only income earned in California is taxed there. For 2018 and beyond you will need to justify any amounts you received tax free.

250 per week for meals and incidentals non-taxable. The following nine tips can make filing your travel nurse taxes easier save you money and help you avoid future tax liability. Specifically in California Tax-Free Stipends can be as much as 1800 per week for housing in San Francisco and 500 per week for Meals and Incidentals MIE.

Tax-Free Stipends for Housing Meals Incidentals. TravelTax specializes in tax preparation for travel nurses and other travel professionals in healthcare IT engineering nuclear Canadian international foreign missionaries and everybody else. Travel nurse taxes are due on April 15th just like other individual income tax returns.

20 per hour taxable base rate that is reported to the IRS. We represent clients before the IRS Canadian Revenue Agency and state tax agencies in audits and resolutions. So YES travel nurses qualify for paid-sick-leave PSL in California.

Here is an example of a typical pay package. It is important to note that this travel nursing tax guide can be used for multiple states. May 9 2019.

The law requires employers to utilize one of 3 methods for allocating PSL to employees. As mentioned above travel nursing pay packages are based on bill rates which are the hourly rates that travel nursing companies are able to charge for an hour of the travel nurses time. ICU Travel Nurse.

Under the new 2018 tax laws deductions or write-offs are no longer an option for travel nurses. Travel pay should be backed up with mileage logs lodging allowances with proof of lodging expenses and of course keep your contracts. A 65 per hour pay rate works out to closer to 20 per hour of taxable income with the rest representing the non-taxable aspect.

Intensive Care Unit Travel Nurse. From our Quick Start scheduling system to our online surveys and secure client portals weve made it easy for you to become a client and have your return professionally prepared at a. Travel Nurse Tax Pro based in southern California is an experienced tax preparation firm that focuses on preparing tax returns for travel nurses and other mobile healthcare professionals.

To help you navigate your travel nurse taxes this year we spoke with Joseph Smith tax guru and president of TravelTax. 2 How is Paid Sick Leave Accrued for Travel Nurses in California. Travel Nurse Tax Questions Videos.

Dont just look at the weekly rate for your travel nurse salary in California but also break it down by hours. You may designate the rest.

What Travel Nurse Benefits Should You Be Receiving Top Class Actions

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Tax Pro Home Facebook

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Talking Travel Nurse Taxes The 50 Mile Rule The Gypsy Nurse

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

The Facts About Taxes Travel Nurse Tax Guide

Trusted Event Travel Nurse Taxes 101 Youtube

Travel Or Staff Nurse Who Makes More Trusted Nurse Staffing

What Is Travel Nursing Academia Labs

Travel Nurse Pay Package Complete Guide With Examples

How Much Do Travel Nurses Make Factors That Stack On The Cash

State Tax Questions American Traveler

Travel Nurse Taxes How To Get The Highest Return Next Move Inc

What Travel Nurses Ought To Know About The Cost Adjusted Value Of Their Pay Bluepipes Blog

Travel Nurse Irs Audit Why They Occur And What To Expect

Are There Red Flags For The Irs In Travel Nursing Pay Bluepipes Blog

Travel Nurse Taxes All You Need To Know Origin Travel Nurses